Tapping into your IRA or 401(k) before retirement

Retirement plans like individual retirement accounts (IRAs) or employer-sponsored 401(k)s offer tax benefits as an incentive to save for retirement. To help ensure you use the accounts as intended, the Internal Revenue Service (IRS) typically imposes a 10% penalty on withdrawals from an IRA or 401(k) before you turn 59½ years old.

Exceptions to the 10% early withdrawal penalty

The IRS will waive the 10% early withdrawal penalty under certain circumstances, including the death or permanent disability of the plan’s owner. Other exceptions depend upon the type of account you have. For example, with an IRA you generally can withdraw funds penalty-free for first-time home purchase ($10,000 lifetime limit), qualified higher education expenses and health insurance premiums while unemployed. With a 401(k), you can withdraw funds penalty-free if you separate from an employer’s service any time on or after age 55.

The IRS maintains a full list of exceptions to the penalty for each type of plan. A “catchall” exception: SoSEPP

If your specific circumstances don’t qualify you for an exception to the 10% early withdrawal penalty, you may still be able to withdraw funds penalty-free by taking what the IRS calls “a series of substantially equal periodic payments,” also known as a SoSEPP. SoSEPPs can be tricky, however—and if the calculations aren’t exactly right, your withdrawals will be penalized.

Calculating SoSEPP withdrawals

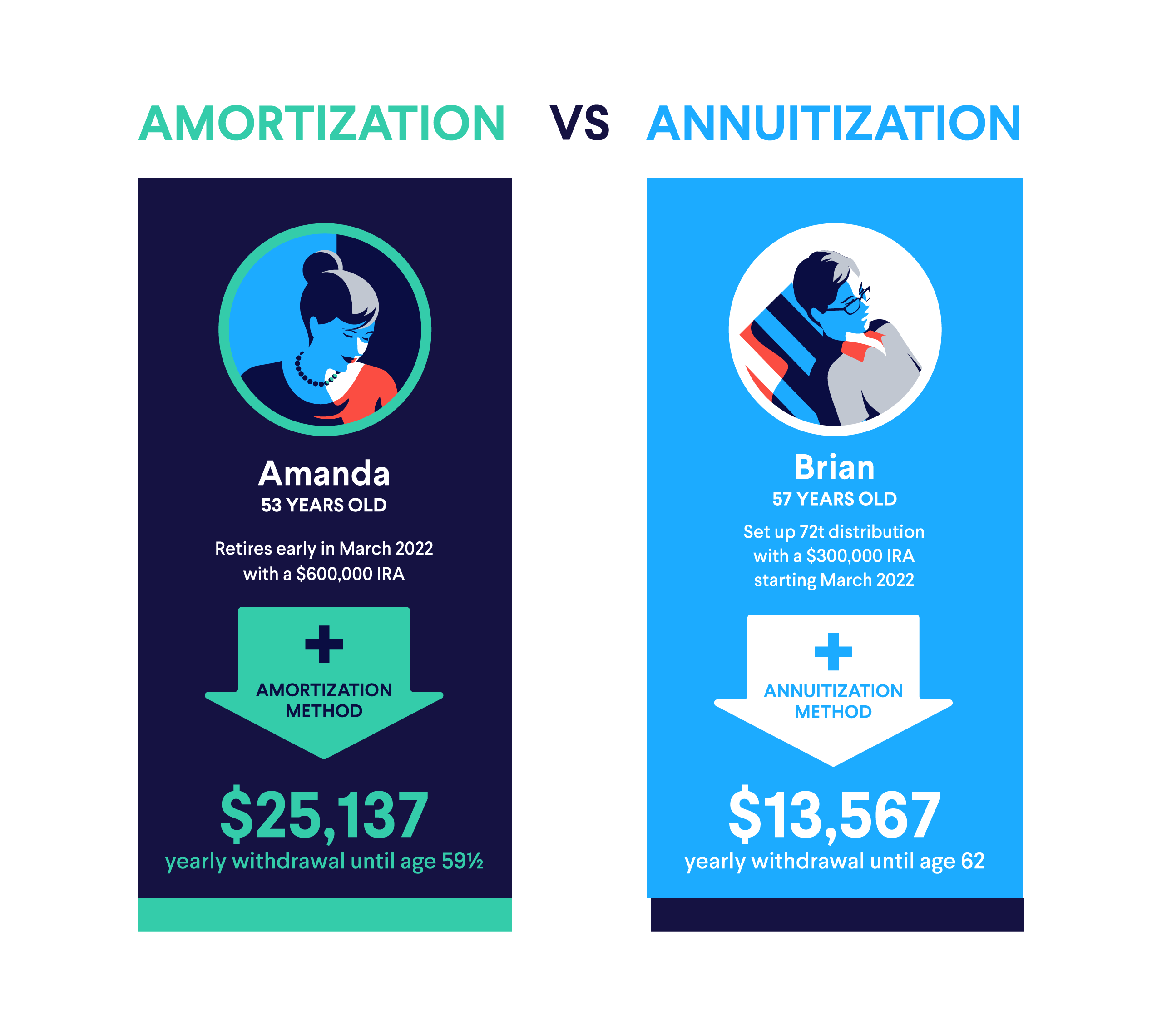

To use a SoSEPP, you first need to calculate a payment amount using one of three prescribed methods. A financial professional or tax advisor can help you figure out which best suits your circumstances. All three methods use life expectancy tables published by the federal government as part of their calculation.

The required minimum distribution (RMD) method. This approach divides your account balance by your life expectancy at the end of each year. The allowed withdrawal will vary from year to year and results in the smallest payment.

The fixed amortization method produces a fixed distribution amount expected to deplete your account balance over your current life expectancy and results in the largest payment.

The fixed annuitization method is the most complex option. It produces a fixed distribution amount based upon your account balance and an annuity factor, which is derived from your life expectancy and an interest rate you select (within specific parameters).

In most cases, you may not modify your payments for until you reach age 59½ or, if you are over age 54½, for at least five years. However, if you have chosen the amortization or annuitization method and you decide you want to withdraw less, you have a one-time opportunity to switch to the RMD method for the remainder of the SoSEPP.

Make an informed decision

These calculations can be complicated, and doing them right is essential. If you break the SoSEPP rules, you will owe the 10% early withdrawal penalty on every dollar you’ve withdrawn under the plan, as well as interest. Seek help from a financial professional and/or a tax advisor, who can help you choose the method that best suits your situation and can calculate the distribution amount for you.

The right calculation method for your circumstances typically depends on your age, the value of your retirement account and your financial needs. Take a hypothetical investor named Amanda. Amanda wants to retire at 53, and she has a $600,000 IRA that she wants to tap immediately for income.

With help from her accountant, Amanda selects the amortization method. It enables her to take a $38,270 distribution each year penalty-free as long as she withdraws this same amount until age 59½. If Amanda were to take more or less in any year, she would have to pay a 10% penalty on all her previous withdrawals from the account, as well as interest.

A few years later, Amanda finds she could live comfortably on less money than she expected. She switches to the RMD method, which preserves more of her assets for later in retirement.

Think carefully before withdrawing retirement funds

In general, it’s best to save assets in a 401(k) or IRA for retirement. That said, you may have good reason to tap your assets early. If so, talk to a financial professional and/or a tax advisor about whether and how you could make early withdrawals penalty-free.